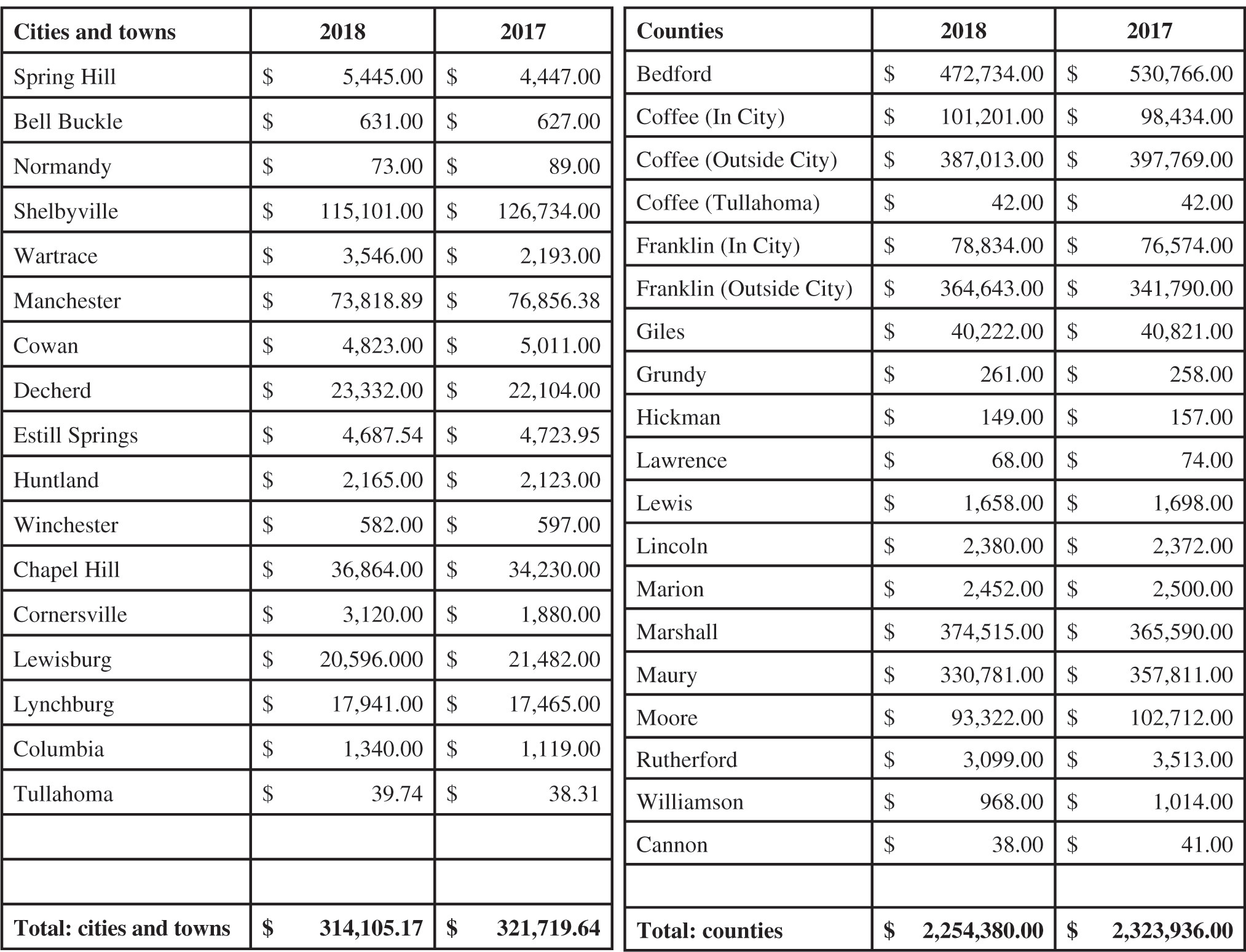

Duck River Electric recently made payments totaling more than $2.5 million for 2018 ad valorem (according to the value of) taxes to city and county governments within the cooperative’s service area, which includes all or portions of 16 counties.

The taxes are based on the assessed value of DREMC’s infrastructure, buildings, substations, transformers, poles, lines, equipment and all other facilities necessary to provide electric service to more than 76,000 members.

Although DREMC is a member-owned, not-for-profit utility, it still has the responsibility to pay its fair share. This annual cost is a part of the budget and has an impact on rates.

Payment of the ad valorem taxes also helps local governments provide important services in those communities they and DREMC serve.

Marshall County Trustee Scottie Poarch, left, accepts a check for Duck River EMC’s ad valorem taxes from Lewisburg District Manager Troy Crowell.